Holdings

Holdings

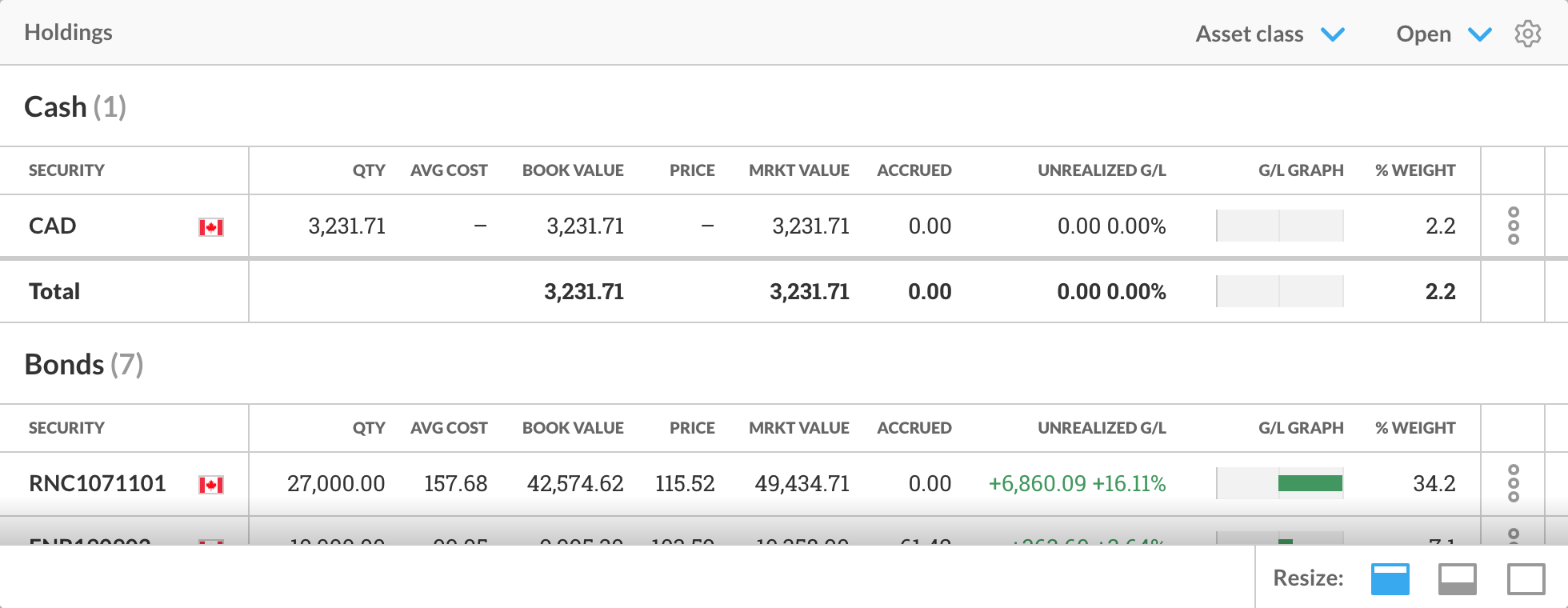

The Holdings widget allows you to view the positions for all the holdings in an account’s portfolio at the As of Date set in the Date Selector. This provides you with details on every holding an account has at that time.

Note: The Date Selector, near the top of the page, is where you set the dates and interval that the widgets in each Workspace and the tools on other pages in the app operate around.

Understanding Positions

Each holding’s position includes:

Security – A security’s name or code, based on your user settings (hover over this entry to reveal the security’s full name, code and its status as an open or closed position)

Security Currency – Type of currency the investor pays or is paid for units of the security, as represented by its flag

Quantity (QTY) – The number of units of a security held in a portfolio

Average Cost (AVG COST) – The average price paid for each unit of a security

Book Value – The total cost for all units of a security in that holding

Price – A price used to represent the value of the shares in a holding on the market at the As of Date set (e.g. the last closing market price for this security)

Total Market Value (Total MV)– Combined value of all units of the holding based on the representative price (described above) at the As of Date set

Unrealized Gains/Losses (UNREALIZED G/L) – Potential profits/losses that would occur if all units of a holding were sold at the As of Date set

Gains/Losses Graph (G/L Graph) – A meter representing the unrealized gains/losses (red represents a potential loss, green represents a potential gain)

Percentage Weight – The percentage of the account’s portfolio this holding makes up

Percentage Yield – Percentage of earnings generated and realized on an investment at the As of Date

These values are meant to provide you with an understanding of a position and its effect on the portfolio it belongs to. If any of these values are not available for a position, the column for that value will be marked off with a dash.

Note: Hovering over the Book Value, Total MV and Unrealized Gains/Losses will reveal a tooltip that breaks down the calculations used to determine those values for a holding. As these calculations involve different elements of a position, this tooltip lets you see how these elements relate to each other.