Returns Inspector

Returns Inspector

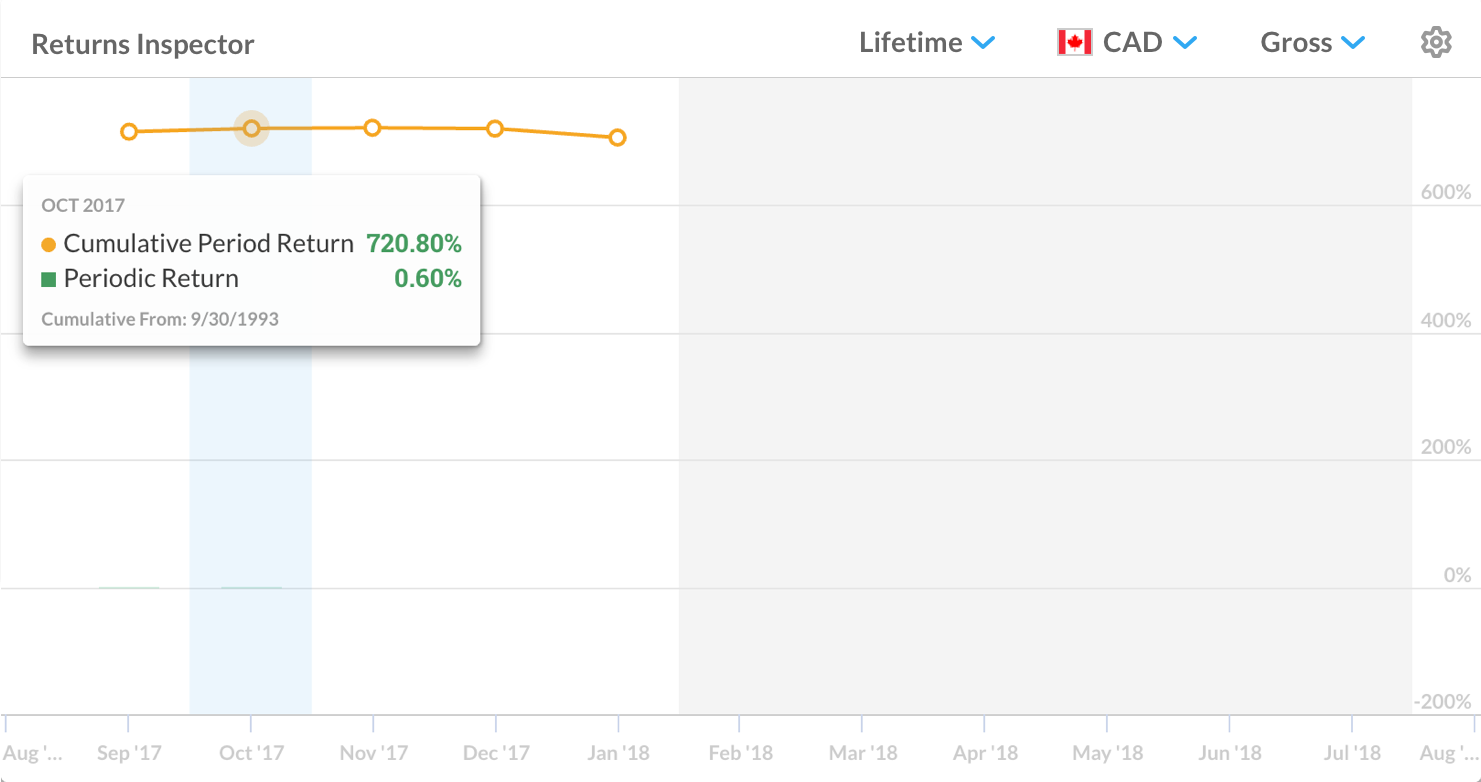

The Returns Inspector widget shows you a portfolio’s Time-weighted Rate of Return (TWRR) within periods during the date range set in the Date Selector, allowing you to see how well an Advisor garnered returns for the portfolio.

Note: The Date Selector, near the top of the page, is where you set the dates and interval that the widgets in each Workspace and the tools on other pages in the app operate around.

A portfolio’s TWRR is the compounded increase or decrease in a portfolio’s value disregarding the net contributions (deposits and withdrawals) account holders make to a portfolio, expressed as a percentage, for each period relative to the beginning of a date range.

Since TWRR disregards portfolio holders’ contributions, it effectively highlights the returns generated by the Advisor.

Note: Periods are determined by the interval you set in the Date Selector (e.g. if you set a quarterly interval, a year-long date range is split into four periods of three months).

The widget allows you to display the TWRR of a portfolio in the currency of your choice. By clicking the arrow with a flag next to it in the widget header, you open the Display Currency menu. Here you can select a currency and then the widget displays the TWRR of the portfolio you are viewing in that currency, overriding the Reporting Currency you set in the Currency Selector in the top right-hand corner of the page.

Note: The currencies you can select in the Display Currency menu are limited by an Advisor. If an Advisor has not set currencies to select for this account, the menu will not open when you click the arrow next to the flag in the widget header.

The widget can also display the TWRR for both the Net (after fees, taxes, etc.) and Gross (before fees, taxes, etc.) value of a portfolio. You can select which type of value to view by clicking the arrow in the right-hand corner at the top of the widget and then clicking either option in the Return Options menu that appears.

Note: An Advisor determines exactly which taxes and fees are included or excluded from a portfolio’s performance when either option is set, so please understand that Gross performance may include the effect of some taxes or fees in its calculations and Net performance may exclude the effect of some taxes or fees in its calculations.