Taxable Activity

Taxable Activity

The Taxable Activity widget provides you with information regarding transactions with taxable consequences executed for an account during a calendar year. This information is necessary for the portfolio holder’s tax reporting purposes. Unlike all other Widgets that use a Trade Date basis, the Taxable Activity widget provides you with information regarding transactions with taxable consequences executed for an account during a calendar year on a settlement date basis.

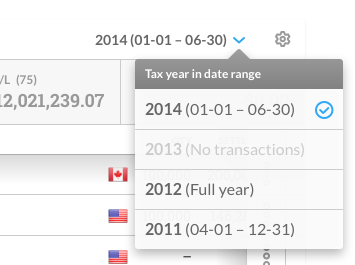

To select which year’s transactions you would like to view, click the arrow in the top-right-hand corner of the widget. This opens a drop-down menu listing all the years within the date range set in the Date Selector.

Note: The Date Selector, near the top of the page, is where you set the dates and interval that the widgets in each Workspace and the tools on other pages in the app operate around.

Years, where no taxable transactions occurred, cannot be selected in the widget. Years where taxable activity was only recorded for part of the year appear in the drop-down list with dates indicating when activity in that year occurred (See Figure 1). Taxable activity is divided by calendar year as the portfolio holder has to file separate reports for each year that taxable transactions occurred.

Figure 1 - In the year selector drop-down, the years with no taxable activity are labelled with “No Transactions”.

If no taxable transactions occurred during the date range set in the Date Selector, the widget displays a message saying so.

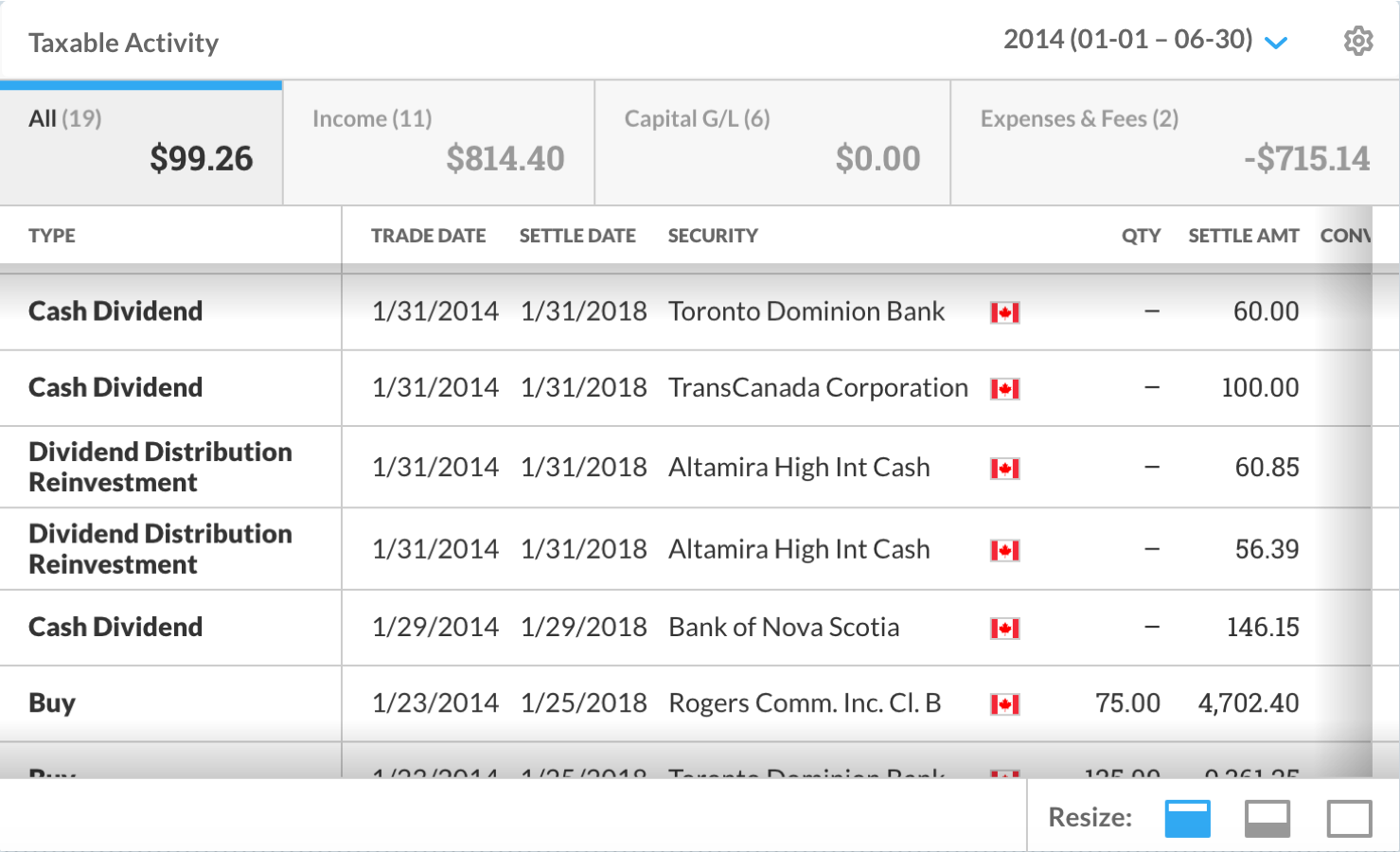

After you select a year, the widget sorts each taxable transaction that occurred that year into categories, displaying their value under tabs as follows:

All – Combined net amount earned from all the different types of taxable transactions

Income – Total amount paid to an investor for holding a security (e.g. dividends, interest)

Capital Gain/Loss – Profits or losses that occurred from all taxable buy or sell transactions

Expenses & Fees – Costs for financial services, regulations, etc. (reported as negative values, as they deduct from net profit)

Each tab heading includes a number in brackets indicating how many taxable transactions are under it, and the latest Balance (see list below) for transactions under that tab.

Clicking each tab will open a table with information on the transactions that fall under it. That information includes:

Type – The kind of transaction that occurred

Trade Date – The date a transaction is carried out (e.g. when an organization acquires units of a security based on an investor’s order)

Settlement Date – The date a transaction is finalized (e.g. when an investor pays for the units acquired on their behalf and gains ownership of those units)

Security – Name or code of the security relevant to the transaction (hover over this entry to reveal the security’s full name and code)

Security Currency – The type of currency that the security is sold in, represented by its corresponding flag

Quantity (QTY) – Total number of units involved in the transaction

Settlement Amount (SETTLE AMT) – Cost of security in the currency the portfolio holder used to make or receive payment

Converted Amount (CONVERTED AMT) – Settlement amount in the reporting currency you set in the Currency Selector

Realized Gain/Loss – Profits or losses that occurred after a “sell” transaction

Balance – Running profit from transactions listed under a tab during a tax year (calculated using Settlement Amount and/or Realized Gain/Loss available for transactions)

Note: The Currency Selector is located near the top right-hand side of pages that include widgets in Client Portal.

Aside from the All tab, tabs do not include every item of information listed above (e.g. the Income tab does not list the Realized Gain/Loss for income transactions as these transactions were not based on the selling of securities).

Transactions are listed under each tab in reverse chronological order so you can see the most recent balance at the top of the list.

In the case that a large number of transactions occurred in the year you select, you can navigate the widget’s listings using the page numbers on the bottom left-hand side or the arrows on the bottom right, and you can enlarge and then shrink the widget using the Resize buttons in the bottom right-hand corner.