Understanding Transaction History

In the last column of the Holdings widget, there is an Options menu ( ⠇) icon corresponding to each holding. You can click this icon, and then click View Transactions in the menu that appears to open the Transaction History window for a holding.

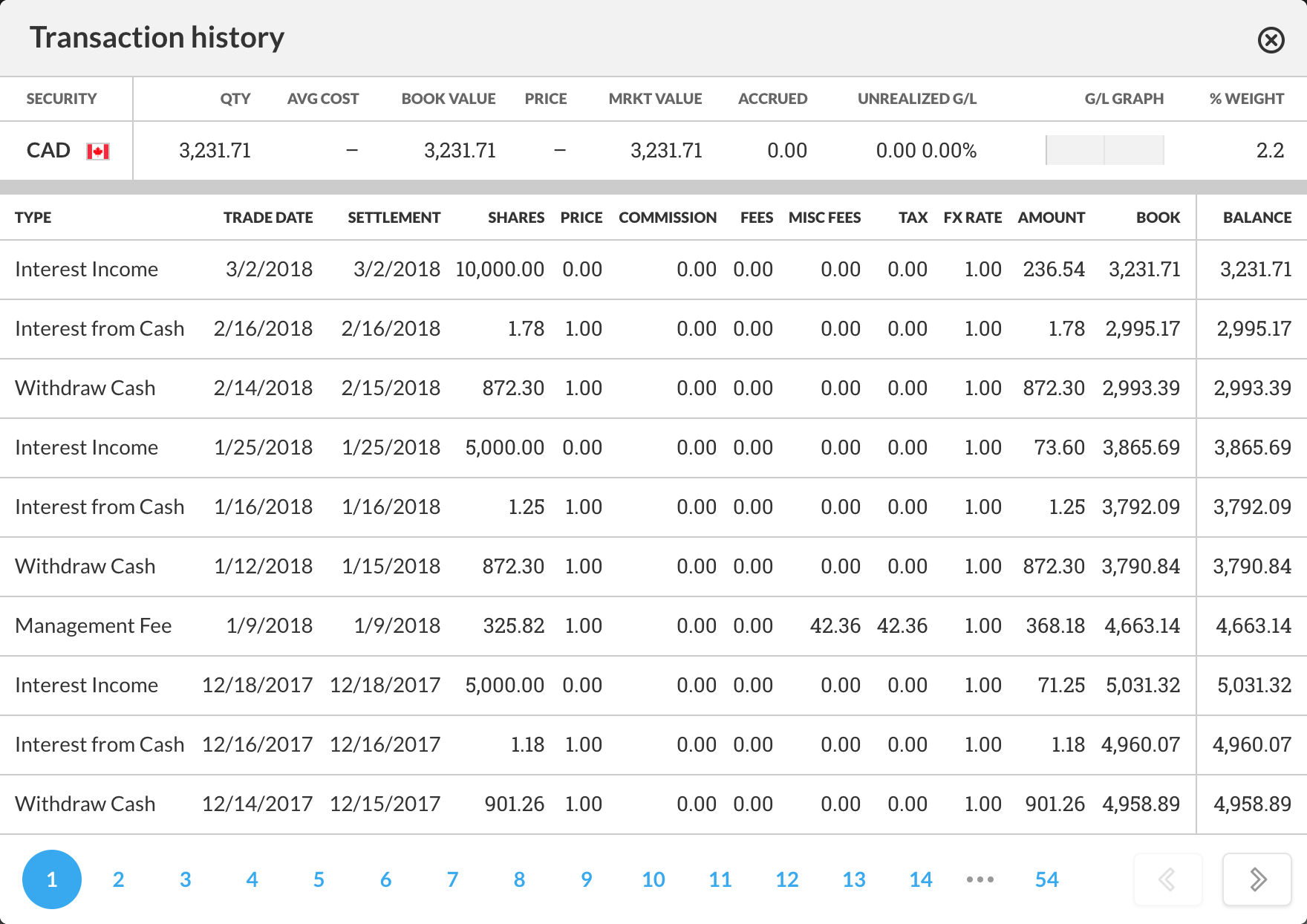

A holding’s Transaction History window (see Figure 1) is a ledger that lists all the transactions that brought the holding to the position it has at your set As of Date in reverse chronological order. The window shows you any changes to the value and quantity of that holding produced by those transactions.

Transaction History

Figure 1 - Transaction history modal

The Transaction History window also displays the position of the selected holding from the Holdings widget (for easy reference) along with the following information relevant to each transaction:

Type – The kind of transaction that occurred (e.g. Buy, Sell, Cash Dividend, Management Fee)

Trade Date – The date a transaction is carried out (e.g. when an organization acquires units of a security based on an investor’s order)

Settlement Date – The date a transaction is finalized (e.g. when an investor pays for the units acquired on their behalf and gains ownership of those units)

Quantity (QTY) – The number of units of a security involved in the transaction

Price – The value of each unit of a security involved in the transaction at the time the transaction was executed

Commission – Service charge proportional to Amount (see below) paid to a broker who facilitated the transaction (e.g. a flat fee per trade or a flat fee per unit of the security traded)

Fees – Fee paid to an organization for executing a transaction (e.g. the Securities and Exchange Commission fee that must be must be paid whenever a U.S. security is sold)

Miscellaneous Fees – Costs that arise based on the circumstances surrounding the transaction (e.g. PTM levy that must be paid for a transaction made on the London Stock Exchange worth over £10,000)

Tax – Taxes paid on the transaction

Foreign Exchange Rate – Rate between the cost paid for security (in the currency used to make payments for security) and the amount the portfolio holder paid or received for that security (in the currency the portfolio holder pays or receives)

Settle Amount – The total value of all the units of a security involved in the transaction in the currency that the account holder paid or received

Book – New cumulative cost of acquiring the holdings in the portfolio on the transaction’s settlement date

Balance – New cumulative quantity of units of that security held after the transaction occurred

These values are meant to provide you with an understanding of a transaction and its effect on a holding’s position.